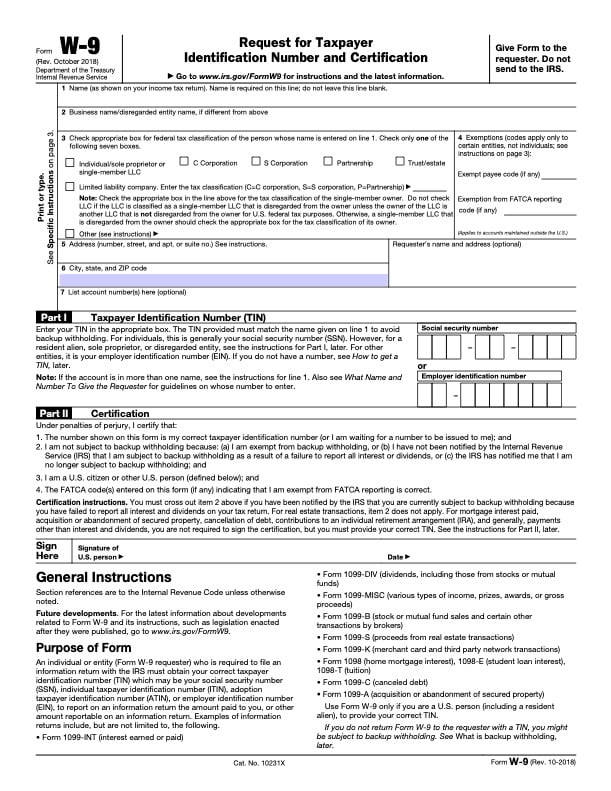

In the US, Form W-9, Request for Taxpayer Identification Number and Certification, is a tax form used by US businesses to get information from independent contractors (freelancers) who are US citizens or US tax residents, regardless of their physical location.

Why do you need Form W-9?

Businesses in the United States working with independent contractors don’t withhold income tax or provide benefits, but the IRS still wants to know how much the contractors received to ensure they are properly reporting their income. For tax purposes, a business needs to file an information return through a Form 1099-NEC when they pay a contractor more than $600 in a year. The Form W-9 is the official way to obtain the contractor's tax ID.

Form W-9 is for US taxpayers to complete. If a US business hires an independent contractor who is not a US citizen or a US tax resident, they collect Form W-8BEN (for individuals) or W-8BEN-E (for entities) instead.

You can download the Form W-9 from the official IRS website or watch a video to see how to complete it.

What is Form W-9 used for?

A Form W-9 serves as a request for Taxpayer Identification Number (TIN) of the person (or business) who needs to file an information return with the IRS report. You may be asked to complete a Form W-9 if you:

- Received income within a tax year

- Had real estate transactions (so you can get a 1099-S)

- Paid interest on a home mortgage or student loan (so you can get a 1098 form)

- Acquired or abandoned a secured property (so you can get a 1099-A)

- Had a cancellation of debt (so you can get a 1099-C)

- Made contributions to an IRA

W-9 forms don't get sent to the IRS—the requestor just uses the information to prepare the 1099 form.

Who needs to collect and file IRS Form W-9?

Every business based in the United States who has contracted a US person as an independent contractor needs to collect a completed Form W-9. Every independent contractor (usually working as a self-employed person or a small business) in the United States needs to fill in the information returned through a Form W-9.

A client, financial institution, or another payer will most likely ask you to fill in a Form W-9. You don't need to file this form to the IRS, only return it to the requester and keep a record of it.

How do I get Form W-9?

You can obtain a copy online. You can use a printed or an electronic version.

How to fill out IRS Form W-9?

To fill out a Form W-9 correctly, follow the instructions below.

Box 1: Your legal name as it appears on your tax documents.

Box 2: Business Name/Disregarded Entity Name. You can choose from the following:

- Sole proprietor/single-member LLC (if you're doing business as an individual and in case you haven't incorporated your business)

- C corporation (if your business has shareholders and a board of directors and you pay taxes separately from the business owners)

- S corporation (if your business doesn't pay corporate income tax, but rather business shareholders split up the income and report it on their own personal income tax returns)

- Partnership (if your business isn't incorporated but rather has shared ownership with other people)

- Trust/estate

- Limited liability company (LLC) (if your business behaves like a corporation (state level) but is taxed like a partnership or sole proprietorship (federal level))

- Other (if you are filing the Form W-9 outside the United States. Check out the IRS's guide to international business entities for more information.)

Box 3: Check the appropriate box to state the type of business entity for federal tax classification: sole proprietorship, partnership, C corporation, S corporation, trust/estate, limited liability company, or "other". If you aren't sure, it's likely a sole proprietorship.

Box 4: Exemptions. Leave blank if you're an individual. Detailed exemption cases are described in the instructions on page 3, but some of them could be either payees who are exempt from backup withholding (corporations, for example) or payees who are tax-exempt under the Foreign Account Tax Compliance Act (FATCA).

Boxes 5 and 6: Your street address, city, state, and ZIP code. Make sure you state the address you will use on your tax return to ensure the IRS can match your forms correctly.. If you are a sole proprietor who rents office space, but you put your home address in the income tax return, you should enter your home address.

Part I

Enter your business's correct TIN.

If you are acting as an individual, enter your Social Security Number (SSN). If you are acting as another business entity, enter your Employer Identification Number (EIN).

If you’re a sole proprietor with an Employer Identification Number, it’s still better to put your Social Security Number instead. It’ll give the IRS to match any Forms 1099 you receive with your tax return (these are filled with your SSN).

If you have a newly-established business entity and still don't have the Employer Identification Number, the IRS suggests you apply for it as soon as possible and state "Applied for". You may be subject to backup withholding in the meantime. If you aren't eligible for an SSN because you're a resident alien, your IRS individual taxpayer identification number (ITIN) instead.

Part II, Certification

Before you sign and complete a Form W-9, confirm the following:

1. The number shown on this form is my correct taxpayer identification number. Never use a made-up or someone else's tax ID number.

2. You are not subject to backup withholding because: (a) you are exempt from backup withholding, or (b) you have not been notified by the Internal Revenue Service (IRS) that you are subject to backup withholding as a result of a failure to report all interest or dividends, or (c) the IRS has notified me that you no longer subject to backup withholding. Most taxpayers are exempt from backup withholding, so if the IRS hasn't notified you about it, you're in the clear. If you are not exempt from backup withholding, the company that hired you will need to withhold income tax from your pay at a rate of 24%._

3. You are a U.S. citizen or other U.S. person._ According to the IRS, a "U.S. person is a partnership, corporation, company or association created or organized in the United States or under the laws of the United States; a domestic estate; and a domestic trust." If you are a resident alien, you are good to go. Remember, if you are not a U.S. citizen, you should be asked to fill out Form W-8BEN (as a foreign individual) or Form W-8BEN-E (as a foreign entity) instead.

4. The FATCA code(s) entered on this form (if any) indicating that you are exempt from FATCA reporting is correct. Ignore if you left Box 4 blank.

To complete the form, sign it with your full (legal) name and the date.

When is the deadline to collect IRS Form W-9?

There is no official due date to collect Form W-9, but it's usually easiest to get this completed and filed before the first payment is made. That way, you're not scrambling to get the required information during tax season.

Disclaimer: This article is to be used for informational purposes only and should not be considered tax advice. Check the official IRS website (irs.gov) for the latest information or seek advice from a tax professional.