Form W-8BEN serves as a declaration of foreign status for non-US citizens and businesses to prevent full 30% tax withholding on income by verifying their tax residency.

- Form W-8BEN usage: Non-US citizens and businesses use Form W-8BEN to certify their foreign status and reduce or exempt them from the 30% tax withholding on income earned in the US.

- Importance of compliance: Failing to submit Form W-8BEN can lead to full tax withholding. The form is vital for foreign contractors and entities working with US companies to ensure tax compliance and avoid unnecessary withholdings.

- 2021 IRS update: The IRS released a new version of Form W-8BEN in 2021, incorporating changes to US tax regulations. It's important to use the most current form to stay compliant.

- Eligibility and validity: Form W-8BEN is intended for individual foreign persons, while businesses should use Form W-8BEN-E. The form remains valid for three years unless changes in personal circumstances occur.

- Tax treaty benefits: Properly completed W-8 forms can enable individuals and entities from countries with tax treaties with the US to enjoy reduced withholding rates, preventing double taxation.

Disclaimer: This article is for informational purposes only and is not intended as tax advice. IRS regulations can be subject to change, so check for updates on www.irs.gov. Consult an accountant or tax advisor for help with tax laws.

What you need to know about Form W-8BEN

Staying compliant and in accordance with labor laws and regulations is crucial for any business, especially for ones working with foreign entities.

Foreign individuals who receive income from a US source are subject to a 30% tax withholding rate, depending on the type of income. Payments made as compensation for a provided service are the most common, but interest, dividends, rents, royalties, premiums, and annuities are all subject to tax withholding.

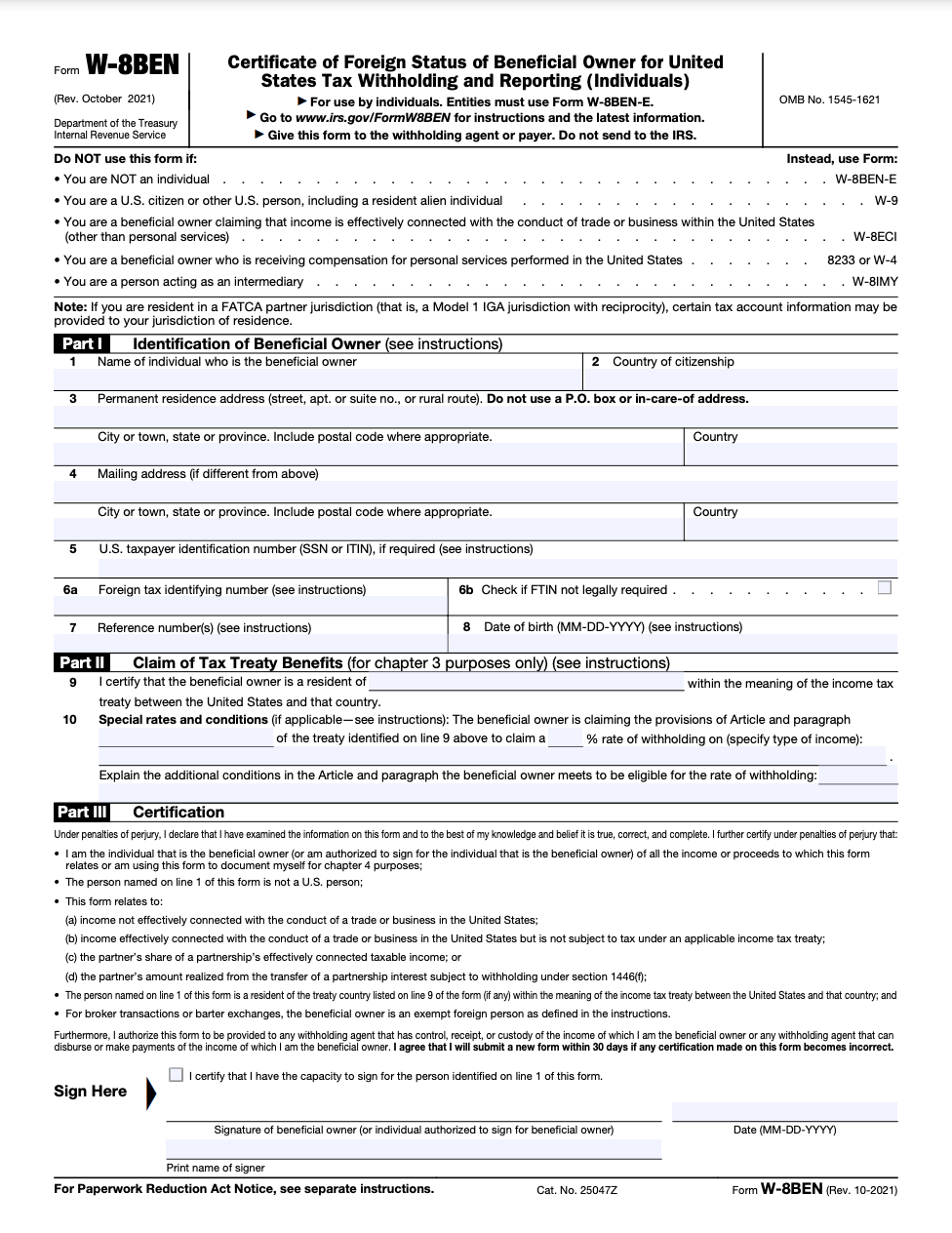

IRS Form W-8BEN is used to certify that a contracted person is a foreign individual is a non-US resident and performs work outside of the United States.

This form, sometimes referred to as a certificate of foreign status, establishes that the contracted individual is both a foreign person and the beneficial owner of the business in question.

As a foreign contractor or employee, you're expected to report your foreign income from the US on your taxes. Submitting a Form W-8BEN can result in a reduced rate of withholding or even an exemption from the withholding tax if you're a resident of a foreign country with whom the United States has an income tax treaty. The treaty means you won't be double-taxed (once by the US government, and once again by your home government), so it's a form worth completing as soon as possible.

Any business in the United States should collect Form W-8BEN from any non-US persons (foreign individuals) or businesses engaged in a contractual agreement. The completed form is collected by the withholding agent or payer, not the IRS.

You can obtain a W-8BEN template from the IRS website.

The 2021 W-8BEN update

In October 2021, the IRS published a new version of the W-8BEN form, updated to comply with changes in US tax regulations. The same goes for the tax form used by foreign entities (W-8BEN-E). The instructions for completing these forms have also been updated.

What's changed in the W-8 forms? There are updates regarding:

- filling out the form on behalf of someone else (allowed; a power of attorney is required)

- disclosure options on jurisdictions where TIN isn't required by the law (check box 6b on the W-8BEN if it's not legally required)

- additional information about foreign governments when they're account holders and payees

- additional information on claiming the tax treaty benefits

In the updated instructions for filling out these forms, you'll find additional information about treaty benefits and electronic signatures.

Old forms may be used for up to six months past the new revision date, so the old 2017 revision can be accepted until the end of April 2022. Of course, it's best to adjust documentation to the new rules as soon as possible. Beginning May 2022, you must use the new 2021 version.

If you already submitted a W-8BEN or W-8BEN-E form, you don't need to submit a new one. Old W-8BEN forms remain valid until their original expiry date or until personal life changes make it inaccurate.

You can download the tax forms here:

-

For individuals: W-8BEN tax form (PDF)

-

For entities: W-8BEN-E tax form (PDF)

When not to use Form W-8BEN

- If you are not an individual, but a foreign legal entity, use Form W-8BEN-E instead (see below).

- If you are a US citizen or other US person, including a resident alien individual, use Form W-9 instead.

- If you are a beneficial owner claiming that income is effectively connected with the conduct of trade or business within the US (other than personal services), use Form W-8ECI instead.

- If you are a beneficial owner who is receiving compensation for personal services performed in the United States, use Form 8233 or W-4 instead.

- If you are a covered expatriate individual who is subject to different tax rules, use the form W-8 CE to notify the payer about your status.

What is Form W-8BEN-E?

Form W-8BEN-E is filed and submitted by a foreign entity, not an individual, that receives a US income.

Similar to a foreign person receiving income, the generated income by foreign entities is typically subject to a withholding tax of 30% by the payer or withholding agent in the United States. The form W-8BEN-E allows the foreign business to claim a reduction in these US taxes if its foreign government has a tax treaty with the United States.

Non-US businesses provide the Form W-8BEN-E for the same sources of income as an individual would with a Form W-8BEN. If foreign entities do not provide an accurate Form W-8BEN-E when required, they risk paying the full 30% tax rate.

As an example, if you're a contractor who is set up as a private limited company or partnership, you'll want to complete a W-8BEN-E.

When should Form W-8BEN or Form W-8BEN-E be issued?

Companies should collect a Form W-8BEN or W-8BEN-E from every foreign person (non-resident alien) that will receive income. Do not provide the W-8 to the IRS.

The W-8BEN is valid for three calendar years, ending on the last day of the third year. For example, if you hire someone in February 2022, the W-8BEN form will be valid until December 31, 2025. If a US taxpayer identification number (TIN) is provided, the form is valid indefinitely.

If the information on the W-8BEN becomes incorrect (for example, you've changed your name, moved to the US, or to a country that doesn't have a tax treaty), you need to provide a new W-8BEN or another appropriate form within 30 days.

How to fill out the W-8BEN

The W-8BEN is completed by the foreign payee. If you're onboarding through the Deel platform, just complete the questions in the workflow and the sections will automatically fill in for you.

Part I: Identification of Beneficial Owner:

Complete Part 1 with your personal information:

- Name of individual - Enter your legally given name as shown on your income tax return

- Country of citizenship

- Permanent residence address: Enter your personal residence address. Do not use a P.O. box or in-care-of address. You should not be using a US address.

- Your mailing address, if different than your permanent residence address.

- US taxpayer identification number (SSN or ITIN), if you have one. Generally, when completing this form for your client or employer, you do not need to obtain a US SIN or ITIN; you can just provide the Tax Identifying Number you usually use in your country of residence, like a social security number, on Line 6.

- Date of birth: use the format mm-dd-yyyy.

Part II: Claim of Tax Treaty Benefits:

If you are a resident of a country with a tax treaty with the US, fill this section to claim your exemption from withholding tax.

List of countries with a tax treaty with the United States

Armenia, Australia, Austria, Azerbaijan, Bangladesh, Barbados, Belarus, Belgium, Bulgaria, Canada, China, Cyprus, Czech Republic, Denmark, Egypt, Estonia, Finland, France, Georgia, Germany, Greece, Hungary, Iceland, India, Indonesia, Ireland, Israel, Italy, Jamaica, Japan, Kazakhstan, Kyrgyzstan, Latvia, Lithuania, Korea (South), Luxembourg, Malta, Mexico, Moldova, Morocco, Netherlands, New Zealand, Norway, Pakistan, Philippines, Poland, Portugal, Romania, Russia, Slovakia, Slovenia, South Africa, Spain, Sri Lanka, Sweden, Switzerland, Tajikistan, Thailand, Trinidad and Tobago, Tunisia, Turkey, Turkmenistan, Ukraine, United Kingdom, Uzbekistan, Venezuela.

If your country of residence doesn't have a tax treaty with the US, leave this section empty. The full list of treaty countries can be found on the Internal Revenue Service's website.

Part III: Certification

To finalize the form, declare that you have examined the information on this form and to the best of your knowledge and belief it is true, correct, and complete, under penalties of perjury. Sign the form with your full legal name and add the date and signature.

How to fill out the Form W-8BEN-E

Part I: Identification of Beneficial Owner

Complete this part with basic entity information, such as:

- Name of organization that is the beneficial owner - Enter the full legal name of the company used for the business registration

- Country of incorporation or organization

- Name of disregarded entity receiving the payment

- Chapter 3 Status (entity type) - Check one box only. Choose between the following: Foreign Corporation, Foreign Disregarded entity, Foreign Partnership, Foreign Simple trust, Foreign Grantor trust, Complex trust, Estate Government, Central Bank of Issue, Foreign Tax-exempt organization, Private foundation or International organization. If the business status differs in your country, tick the one that is the closest to the local entity type.

- If you entered disregarded entity, foreign partnership, foreign simple trust, or foreign grantor trust in the question above, you will need to state if the entity is a hybrid making a treaty claim. If you tick "Yes", you will need to complete Part III. If you tick "No", you can skip Part III.

- Chapter 4 Status (FATCA status)

- Permanent residence address (street, apt. or suite no., or rural route) - Enter detailed business residence address. Keep in mind that you cannot use a P.O. box or in-care-of address.

- Business mailing address, if different than the business permanent residence address

- US taxpayer identification number (TIN), if applicable

- GIIN and Foreign Tax Identification Number (TIN)

Part II: Disregarded Entity or Branch Receiving Payment

Complete only if a disregarded entity with a GIIN (global intermediary identification number) or a branch of an FFI in a country other than the FFI's country of residence.

- Chapter 4 Status (FATCA status) of disregarded entity or branch receiving payment

- Address of disregarded entity or branch (street, apt. or suite no., or rural route). Keep in mind, you cannot use a P.O. box or in-care-of address (other than a registered address)

Part III: Claim of Tax Treaty Benefits (if applicable)

In this section, you should certify all the following if they apply to your business:

- The beneficial owner's country of residence that has a tax treaty with the US

- The beneficial owner derives the item (or items) of income for which the treaty benefits are claimed, and, if applicable, meets the requirements of the treaty provision dealing with limitation on benefits.

- The beneficial owner is claiming treaty benefits for US source dividends received from a foreign corporation or interest from a US trade or business of a foreign corporation and meets qualified resident status.

Add any special rates and conditions, if applicable to your case. If you are claiming the provisions, state the article and paragraph of the treaty identified on the lines above to claim a % rate of withholding and specify the type of income. Explain the additional conditions you meet to be eligible for the rate of withholding.

Payees that may be eligible for a tax reduction or even exclusion are typically foreign governments and foundations, and they need to fill out the Form W-8EXP.

In Part IV to Part XXIX, state all the applicable elements regarding foreign financial institutions that have a tax treaty with the United States.

To finalize the form, read and make the required declarations and certifications.

Fill in and collect W-8BEN automatically through Deel

Staying compliant with the local laws is the number one concern for many employers wanting to hire internationally, but don't let it stop you from diving into the global talent pool.

Deel ensures each contract a full-time employee or contractor signs is entirely compliant with local regulations. Finally, there is no need to learn a new set of rules each time you're ready to hire in a new country.

At Deel, we often help US-based businesses who want to hire contractors and employees located all over the world and need this form. You can also use Deel to automatically collect W-8BEN and W-8BEN-E forms from your international contractors and employees. Completed forms are securely stored in your Deel dashboard.

Sounds like the solution you're looking for? Read all about managing compliance seamlessly and book a demo to see Deel in action today.