Should You Use a PEO vs Payroll Provider? Benefits, Limitations, and Alternatives

Key takeaways

- Outsourcing HR and payroll tasks can help you increase your pace of technology, access new capabilities, and get ahead of increasingly complex cybersecurity threats.

- PEOs cover a variety of HR services, including payroll, benefits, and compliance, while payroll service providers focus solely on payroll and taxes.

- Working with a PEO requires a co-employment relationship, where your company and the PEO share legal responsibility for your employees. Working with a payroll provider does not.

Companies have several options for streamlining back-office operations, especially when it comes to managing payroll. Two of the most common solutions are outsourcing payroll through a payroll service provider (PSP) or partnering with a professional employer organization (PEO) for comprehensive payroll and HR management.

Your selection will be influenced by your business needs, in-house capabilities, and the complexity of local employment and tax laws. Let’s look at the main differences between PEOs and payroll providers and how they compare to other HR services.

What is a PEO?

A PEO is a third-party service provider that enters into a co-employment relationship with an employer to provide key HR services, including payroll, employee benefits administration, risk management, and compliance assistance, among others. Working with a PEO enables companies to outsource HR tasks they don’t have the time, budget, or expertise to handle in-house.

What is a payroll service provider?

A payroll service provider is a company that provides employers with support for payroll and tax-related processes. They do not typically support additional HR functions or administrative tasks outside of payroll, but can often recommend additional providers for benefits, insurance, and more.

Employee relationship

PEO

Co-employment is a unique employment arrangement involving a three-party relationship between a company, its employees, and a professional employer organization. In this setup, the PEO becomes a co-employer with the client company, sharing certain employer responsibilities and liabilities.

Here’s how a co-employment relationship works with a PEO:

The client company maintains control over its core operations, products, and services. The client company hires and manages its employees, defines their roles and responsibilities, and oversees day-to-day work activities.

The employees are the individuals who work for the client company. They report to the client company’s management, follow its policies and procedures, and carry out the tasks necessary for the company’s operations.

The PEO is a specialized organization that provides employment-related services to the client company. The PEO becomes a co-employer of the client company’s employees for HR, payroll, and legal purposes.

Payroll service provider

With a payroll service provider, there is no co-employment relationship—your company directly employs the workers. The PSP exclusively handles payroll-related tasks, including managing local, state, and federal tax filings, tax compliance documentation, wage calculations, deductions, and employee and employer tax payments.

Overall, engaging a payroll provider positively impacts the employee-company relationship through efficient and accurate payroll processing, compliance with tax laws, and enhanced data security. By providing reliable and transparent payroll services, companies can foster trust in the workplace and promote open communication to improve job satisfaction.

See also: Employee Misclassification Guide: Independent Contractor or Employee?

HR management and expertise

PEO

As a co-employer, the PEO plays an important role in your organization by managing various HR responsibilities throughout the employee lifecycle, including but not limited to:

- Federal, state, and local benefits compliance

- Locally compliant employee training

- HR policy development

- Employee handbooks creation

- Employee onboarding and offboarding

- PTO management

- COBRA administration

- ACA compliance

It’s important for your PEO to have a team of HR specialists who are well-versed in the employment laws and regulations of your particular region. With this localized expertise, you can get the latest guidance to ensure your HR practices comply with the relevant labor laws and workplace regulations.

Payroll service provider

With a payroll service provider, you retain full responsibility for handling HR-related tasks, such as employee onboarding, training, performance management, and compliance with labor laws. While most providers don’t directly offer employee benefits, some may provide support with benefits enrollment and deductions from employees’ paychecks.

Payroll and taxes

PEO

When you partner with a PEO, they take on the responsibility of processing payroll for your employees. PEO payroll management typically includes:

- Calculating employee wages and payroll taxes

- Issuing paychecks and payslips

- Generating payroll reports

- Tax filing and preparation as per federal, state, and local requirements

- Ensuring workers’ compensation coverage

As co-employers, PEOs are responsible for your company’s payroll compliance. A crucial part of their role involves staying up to date with ever-changing tax regulations and ensuring your employees are paid accurately and on time every pay period. Working with a PEO can also provide your employees with more diverse payment options, such as getting paid in crypto or getting paid on demand.

See also: Top 6 Reasons to Consider Payroll Outsourcing (and How the Process Works)

Payroll service provider

A payroll service provider offers a specialized service focused solely on processing payroll for the client company. Each client company has a separate payroll system and is responsible for providing the necessary information to the payroll provider.

A payroll service provider calculates payroll taxes based on the information provided by the client company and generates payroll tax reports. Some payroll service providers, like Deel, also help you file federal, state, and local payroll taxes. The provider focuses primarily on payroll compliance and may not offer the same comprehensive HR compliance support as PEOs.

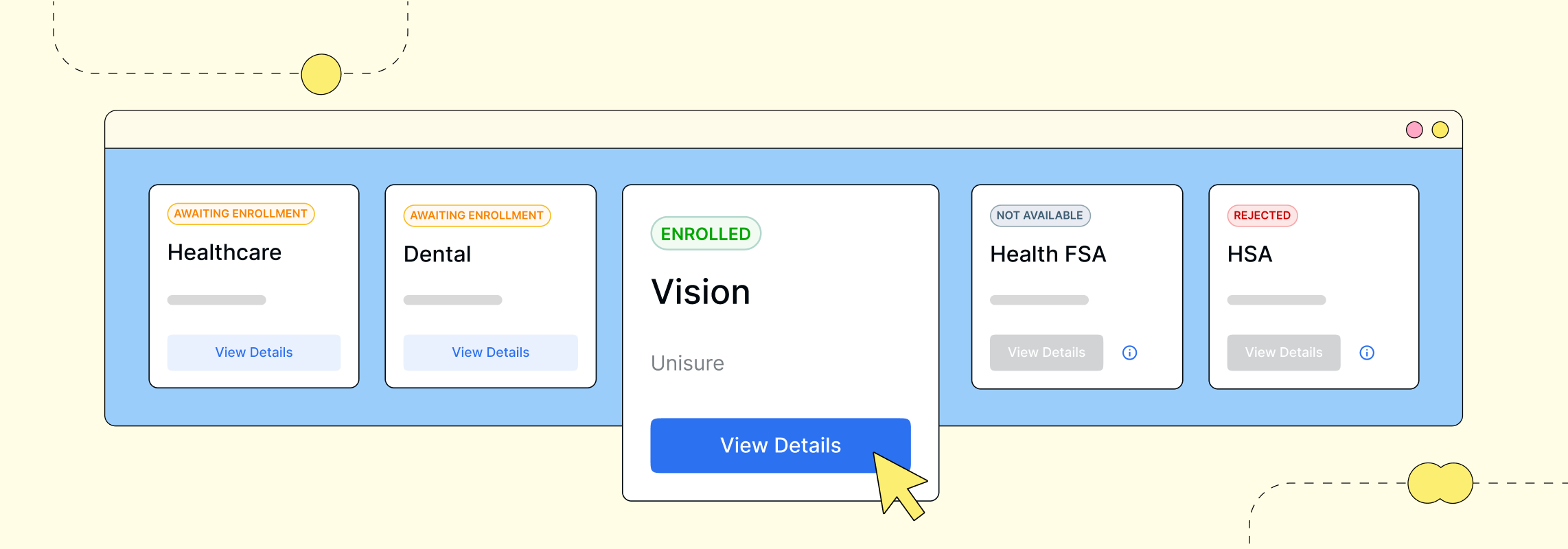

Employee benefits

PEO

When you partner with a PEO, they handle benefits administration and associated compliance and administrative duties on your behalf.

The PEO will ensure the benefits package provided to your workforce complies with local statutory requirements, such as providing health insurance, dental and vision coverage, or retirement plans. They should also work with you to identify competitive benefits and perks that can help attract and retain talent.

PEOs typically manage employee benefits enrollment, negotiate with insurance carriers, and provide legal notices whenever there are changes to the benefits plan. Additionally, PEOs can assist employees in understanding their benefits, support them during the enrollment process, and address frequently asked questions for you.

A PEO provider can often offer group benefits packages, pooling together employees from multiple client companies. This can lead to potential cost savings and access to benefits that smaller companies might not be able to secure on their own.

Payroll service provider

Payroll service providers primarily focus on payroll processing tasks and typically do not offer a comprehensive suite of employee benefits. In most cases. the payroll company can refer you to benefits provider partners to help set up and manage your benefits program. Alternatively, you should be able to integrate your own benefits providers with the payroll services.

With Deel, you can easily add localized benefits administration to your payroll service. This optional addition provides you with access to our built-in benefits administration and HRIS, Deel HR.

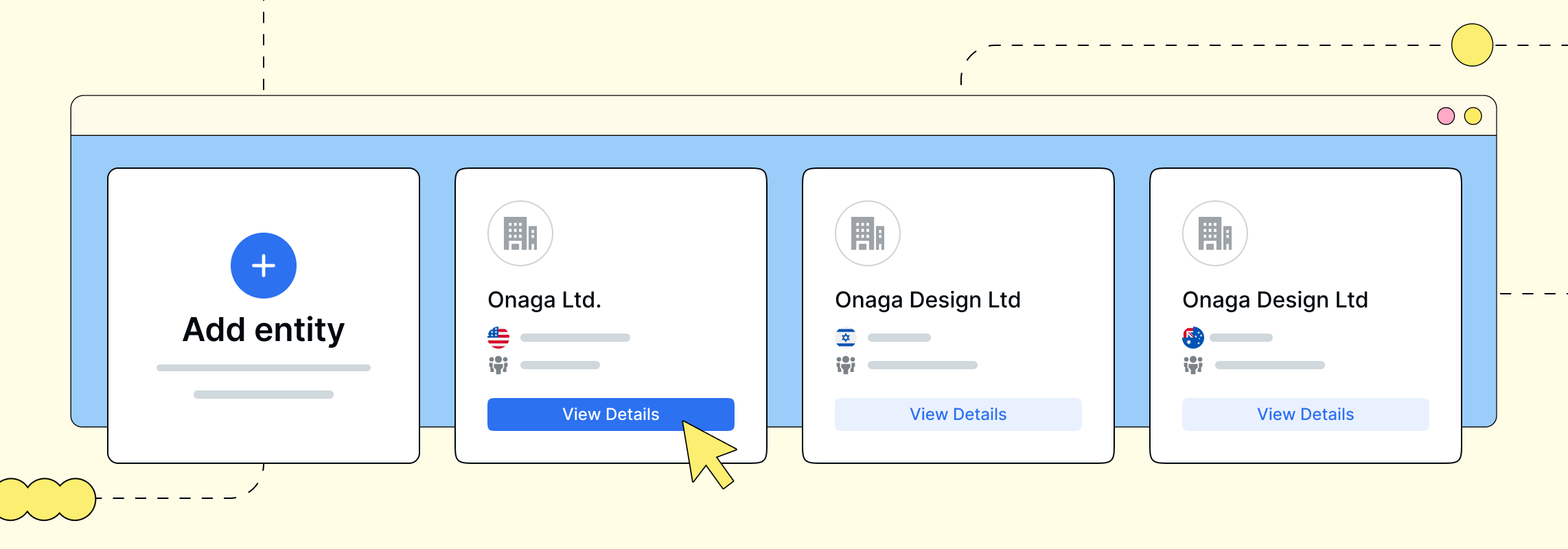

Entity registration

PEO

Before you can work with a PEO, you must register your business in every state where you employ workers. In the US, registration requirements vary from state to state based on the business entity type, location, and the nature of the business.

While these variations often complicate the registration process for business owners, a PEO can guide you through the following steps to ensure compliance:

- Establish and register your legal entity with the appropriate state authorities, following all necessary procedures and obtaining the required licenses and permits

- Obtain an employer identification number (EIN) from the IRS to facilitate tax filings and payroll processing

- Ensure compliance with all relevant federal, state, and local laws and regulations governing employment, taxation, and reporting

- Review local insurance requirements, as the PEO may provide certain insurance coverage, such as workers' compensation, as part of the co-employment arrangement

Payroll service provider

A payroll service provider is there to help you manage your payroll, but they don’t handle the process of setting up or registering your company.

Instead, it’s your company’s responsibility to handle the registration with each state where you intend to run payroll, and ensure compliance with all relevant employment laws, tax regulations, and reporting requirements that apply to your industry and location.

Some companies, like Deel, offer employer of record (EOR) services that enable companies to hire employees without setting up legal entities themselves.

Employee claims

PEO

PEOs typically offer assistance with employee claims management. They have HR professionals who can handle various types of claims, such as those related to workplace disputes, workers’ compensation, harassment, discrimination, or grievances.

They often mediate between the employer and employees to resolve claims in a fair and impartial manner, working towards a mutually satisfactory resolution. PEOs also handle all paperwork and maintain communication with employees and insurance companies.

Payroll service provider

Unlike a PEO, a payroll service provider does not share liability for HR-related issues or employee claims. The client company retains full responsibility for handling and resolving employee issues, while payroll service providers focus primarily on payroll processing tasks. If any claims arise, your company will need to manage all paperwork and handle claims directly with the insurance provider and affected employees.

Workers’ compensation

PEO

A PEO can help you navigate workers’ compensation by providing coverage and handling risk management on your behalf, including compliance issues, paperwork, partnerships, and program certification requirements.

Some PEOs—specifically those that specialize in physical labor industries—have a designated workers’ comp team. If your business is in an industry with high rates of workers’ compensation incidents, seek a PEO with specialization.

Payroll service provider

Most payroll service providers don’t directly cover workers’ compensation. Instead, the responsibility falls on the client company, though many payroll service providers can refer you to workers’ compensation insurance partners or brokers to obtain suitable workers’ compensation coverage.

PEOs vs. other HR service providers

Some PEO responsibilities overlap with other HR service providers, complicating the decision-making process. Here’s a quick overview of how they compare.

Employee leasing companies

The main difference between a PEO and an employee leasing company (ELC) is their relationship with the employees.

Employee leasing companies provide a company with new workers, usually for temporary projects. After the leased employees complete the work for the company, they return to the ELC to find another short-term job.

A client company hires a PEO to handle HR tasks. Once a PEO and client company terminate their relationship, the employees stay with the client company, and their ties with the PEO cease. PEOs do not provide the company with a supply of new employees.

Temporary staffing services

Like an ELC, temporary staffing services provide client companies with additional staff. These organizations recruit workers for companies experiencing seasonal shortages, temporary skill shortages, or employee absenteeism.

Administrative services outsourcing (ASO)

Under an ASO arrangement, the client company retains full employer status and must report payroll taxes using its own employer identification number. Companies can also maintain their existing benefits and workers’ compensation providers with an ASO.

Human resources outsourcing (HRO)

With an HRO, the client company retains full administrative employer status. However, unlike PEOs and ASOs, HROs provide specific HR team tasks based on their experience and specialty. HROs are popular with larger companies that have developed internal departments and only require specific HR expertise.

Employer of record (EOR)

Like a PEO, an employer of record takes care of a company’s human resources while the company manages the employee’s day-to-day activities, schedules, and workloads. However, an EOR is the legal employer of your workforce, which means they assume complete responsibility for your full-time employees.

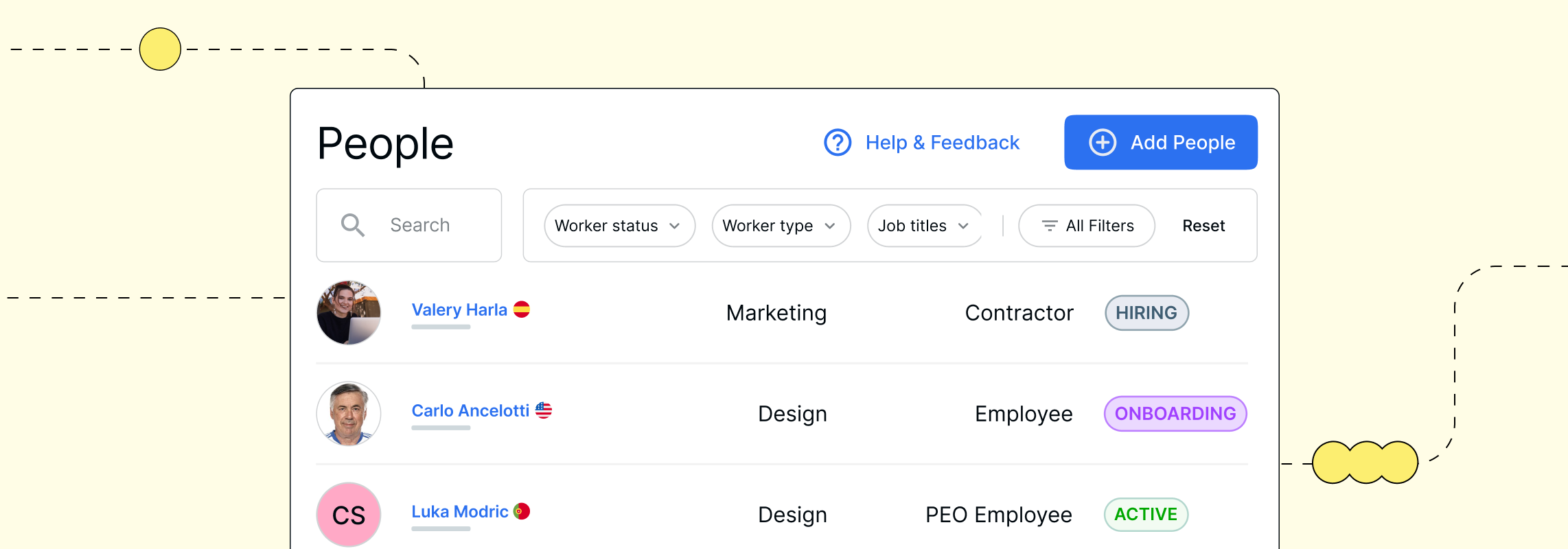

Simplify payroll and HR management with Deel

Every business needs payroll and HR experts to ensure their organization runs smoothly and compliantly. However, not all companies have the funds, expertise, or resources to employ a full-time, in-house team.

In 2022, over half of surveyed business owners opted to outsource managed services to keep up with technological advancements, access new capabilities, and stay ahead of cybersecurity threats.

As an all-in-one HR solution for global teams, Deel simplifies payroll, tax compliance, and employee management by bringing everything into one platform. From payroll and HR to immigration support and equity, Deel has everything you need to manage your workers in the US and beyond.