A Complete Guide to Paying International Contractors in 2023

Key takeaways

- Independent contractors typically receive payment by invoicing their clients. The client then makes the payment using the agreed-upon payment method and schedule.

- The payment method will depend on the contractor’s local labor laws, the associated fees, and the contractor’s preferences.

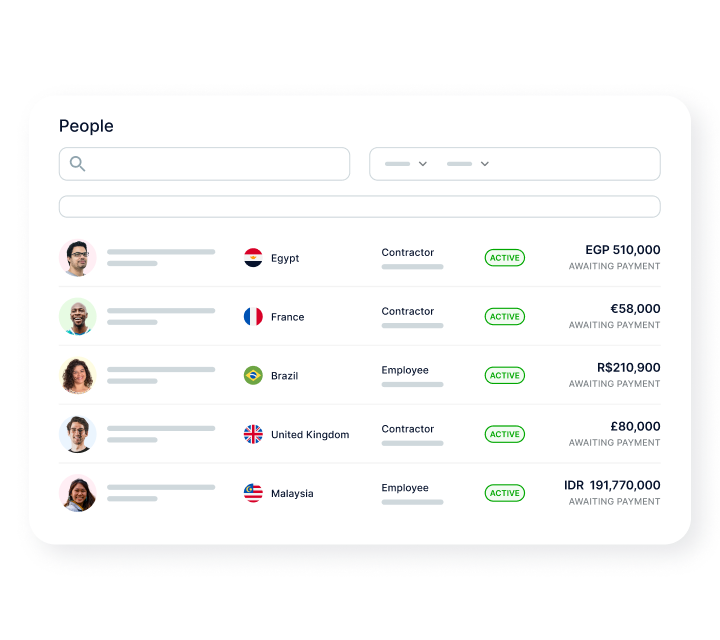

- Deel’s payment platform enables companies to pay contractors and employees in one click compliantly. The platform also collects the necessary tax forms, provides multiple currency options, and gives contractors various withdrawal methods.

Companies continue to tap into the global talent pool for high-performing employees and independent contractors. The proof is in the Deel Lab’s State of Global Hiring Report, which found that 89% of contracts created on the platform in 2022 were for remote workers.

While paying foreign independent contractors is more straightforward than paying foreign employees, it’s still one of the most complex parts of hiring contractors. It requires choosing international payment methods, navigating fees, and complying with foreign taxes—all of which are made easier with Deel.

Deel enables global teams to pay international contractors with one click, dozens of currency options, and flexible payment terms. You can also automate invoices and payments to eliminate human error and ensure a seamless experience for your entire team.

Use this guide to learn more about Deel and other payment options, as well as the tax implications you may encounter when working with international contractors.

Note: While this content references US tax requirements and related forms, Deel enables companies worldwide to easily hire and pay contractors.

Payment schedules for foreign independent contractors

Choosing a payment schedule goes hand-in-hand with choosing a payment method.

You can approach payments to independent contractors in several ways. Usually, independent contractors invoice the client for the work, and the client pays them using a payment method they agree upon in advance by the due date stated in the invoice. Contractors may require different payment cadences from their clients.

Upfront payments

Some independent contractors require upfront payments, wherein their clients must pay for their services in full before starting the project. Although this minimizes the risk of not getting paid for the contractor, it increases the risk for the client. If the work provided is incomplete or you’re not satisfied with the result, it can be a hassle to get a refund, and you may need to hire legal help to solve the dispute.

However, if you’ve been working with a contractor for a long time, paying your contractor upfront can be a sign of good faith that can improve your client-contractor relationship.

Milestone/project completion payments

Paying the independent contractor after they achieve a milestone or complete the work is the safest option for the client. However, it may increase the risk for the contractor. Your independent contractor can decrease this risk by clearly communicating the terms of the project and signing an independent contractor agreement.

Downpayments

Unlike paying your contractor upfront, a downpayment means paying a portion of the total service cost. Downpayments are a great median solution if you work with an independent contractor for the first time. Paying for the project partially will provide safety for the contractor, incentivizing them to do great work promptly.

Hourly payments

You can pay the independent contractor by the hour on your agreed payment schedule. If the project is long-term, define the payment schedule in the contract so the contractor knows when to expect the money: weekly, monthly, or semi-monthly.

Flexible payments with Deel

With Deel, you can select your own payment schedule (in compliance with local laws) and choose from Milestone, Fixed Rate, and Pay As You Go contracts for contractors to offer maximum flexibility. Out-of-cycle, one-off payments are available for contractors on Fixed Rate or Pay As You Go contracts. And with Deel’s Mass Pay feature, you can pay all independent contractors at once with direct debit when payments are due, or manually select payees.

Payment methods for foreign independent contractors

Payment methods for foreign independent contractors

Once you’ve determined the payment schedule, you must select the best way to make international payments. Compare payment options based on implementation speed, fees, security, availability, and contractor preferences.

International bank transfer (SWIFT)

A global money transfer network, SWIFT, connects financial institutions worldwide. Companies worldwide pay their contractors via international bank transfers since this network has around 11,000 bank members in approximately 200 countries.

One of the most significant benefits of using SWIFT is the network’s security. However, some contractors may not prefer this payment method because international wire transfers can have hefty bank fees (typically between 3 - 5%) and unfavorable exchange rates.

International money orders

Although outdated, international money orders are another way to send your international contractor money. These payments are an alternative to cash and look similar to traditional paper checks. Like with international bank transfers, fees, and exchange rates can significantly increase the cost for the payer and the total amount received by the contractor.

The downside of international money orders is that you must know and comply with local tax laws. The process can be inefficient as the transaction is often extremely slow. For example, the payer must physically purchase the money order at the post office, bank, or Western Union outlet. Upon receiving the money order from the payer, the payee (international contractor) must deposit the payment physically.

Daniel Aksioutine, COO, Divbrands

Digital wallets

A digital wallet is a popular form of online money transfer used for paying foreign contractors. It’s usually an online service or payment app where you can store your money, make online payments, or transfer money to your bank account.

The most significant benefit of digital wallets is that you can transfer money in just a few clicks (or one click if you’re a Deel client) and combine it with different withdrawal methods, such as SWIFT, PayPal, or Payoneer, for example.

Cryptocurrency

Paying contractors in Cryptocurrencies can help you avoid high exchange rates and bank fees. Digital currencies are gaining popularity and have become a huge benefit that can attract global talent to your company. Speed and low cost are the most significant advantages of paying your contractor workforce in Crypto and the number of withdrawal options they provide.

Deel supports payments in Cryptocurrencies such as USD Coin, Bitcoin, and Ethereum.

Looking to scale quickly?

Money transfer services

A money transfer service is an online solution that allows business owners to send money to contractors. Most will enable you to send money instantaneously without the fee associated with SWIFT payments. Popular money transfer services include:

PayPal

PayPal is available in more than 200 countries and supports 25 currencies. Transaction fees are quite low: 2.9% + $0.30 in the US and 3.9% + exchange rate for international transfers. PayPal allows international payment through a company credit card and money transfers to a local bank account.

Revolut

Revolut offers a money transfer system and deals in gold and Crypto payments with no hidden fees. The service also provides a card that currently supports around 130 local currencies. You can choose among different subscription options depending on your company’s needs, the number of contractors, and their location.

Wise

Wise is another international payment method with the fairest exchange rate, allowing local bank payouts in multiple currencies, but it’s only available in approximately 59 countries. This platform typically works best for companies that don’t transfer large sums of money and only have contractors in the supported countries.

How Video Husky compliantly manages and pays 50+ global contractors

Video Husky helps companies turn their video creation process into an efficient production line for one flat fee.

Before Deel, Video Husky used PandaDocs for contracts and Wise (Transferwise) for payments. There was no “issue” in terms of usability. However, there was one big red flag: compliance.

Working with over 50 contractors around the world, and as an American company, there’s potential for things to go wrong. With Deel’s tax compliance and contract compliance features, Video Husky can ensure they have all the correct documents and legal information needed to comply with local laws worldwide.

Now, Deel makes managing over 50 contractors easy for Video Husky, and they don’t have to worry about anything falling through the cracks.

Payoneer

Payoneer has a global presence like PayPal and offers multiple options for money withdrawal, including their own Mastercard.

Payoneer ships the card worldwide, so it can be an excellent alternative for your contractors since they can use the money as soon as it arrives in the account. However, Payoneer fees are substantially higher: they charge for loading the debit card, currency exchange, and transferring money to your bank account.

Deel

Deel ensures your independent contractors get paid quickly and correctly, wherever they’re located. You can pay employees and contractors with one bulk invoice every month and enable contractors to receive their paychecks up to 30 days earlier.

|

Competitors |

|

Deel |

|

Most don’t provide Global Payroll services, which makes their solutions less scalable |

Scalability |

Combines contractor payments, EOR, and Global Payroll in one platform |

|

Most only offer bank transfers and direct debit or credit card |

Funding methods |

10+ funding methods for clients |

|

Most only offer bank transfers |

Payment options |

15 payment options including Crypto |

|

No competitor offers a physical contractor’s card |

Contractor’s card |

Contractor’s card for direct access to their Deel balance |

|

Some of them offer advance payments but at a high cost |

Advance payments |

Advance payments available 30 days before contractors' scheduled pay |

|

Fewer currency options |

Currencies |

200 currency options |

|

Many require manual invoicing and payments |

Automation |

Automated invoicing and payments |

|

Many don’t comply with SOC2 requirements or run in-app background checks or United States Office of Foreign Asset Control (OFAC) checks. Few offer Know Your Customer (KYC) checks |

Security |

IP Rights protection, KYC, OFAC, background checks, GDPR, and SOC2 compliance |

|

Many have hidden fees and unpredictable monthly payments |

Pricing |

Flat rate, predictable, and no hidden fees |

From collecting legal documents to making payments in line with locally compliant contracts, Deel does it all for you. You can also integrate Deel with your favorite accounting tools (such as Quickbooks, Xero, and Netsuite) for a seamless experience. Learn more about how Deel makes hiring and paying international contractors easy.

Compliance issues when paying foreign independent contractors

Companies hiring foreign independent contractors must avoid legal risks and penalties associated with improper hiring practices. Avoiding risk comes down to complying with local labor laws regarding worker classification and tax filing. We explain these compliance matters in more detail below.

Local labor laws regarding employee classification

Employers looking to hire contractors from different countries, such as Denmark, Canada, Argentina, or Sri Lanka, must comply with varying employment laws in each jurisdiction.

Issues arise when the definition of an independent contractor in the company’s country doesn’t match the one in the foreign contractor’s country.

For example, according to US law, an independent contractor’s status is defined as an individual or entity providing services to the general public, often working on multiple projects and paying local taxes. The business can only control the result of the work, freeing the contractor to complete it whenever and however they prefer.

The law may consider an independent contractor a full-time employee if the business controls the working relationship. In this case, the company must pay employment benefits (social security taxes, health insurance, pension plan, and unemployment insurance) through tax withholding. Failure to do so is employee misclassification.

In other countries, foreign worker classification rules may differ slightly. Companies should seek support from local legal experts who can ensure full compliance with contracts and avoid potential employee misclassification penalties. Some countries also require obtaining an independent contractor license, which can help decrease misclassification risks.

Your independent contractor agreement should clearly outline your contractor’s worker classification. If your relationship does not align with the country’s definition of an independent contractor, consider hiring your foreign worker as an international employee in their local country. This approach requires different hiring processes, possibly through an employer of record (EOR).

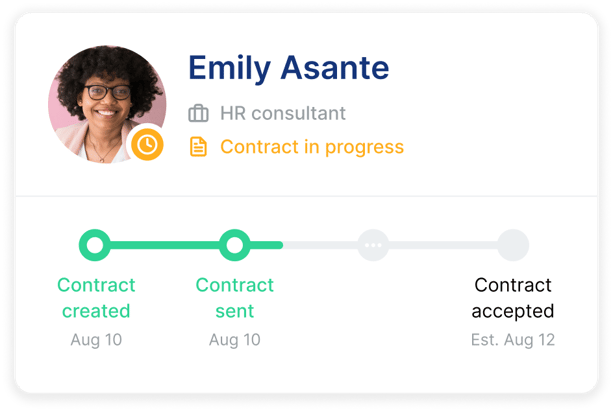

To eliminate any possibility of misclassification and liability when hiring independent contractors, use Deel Shield. Here’s how it works:

- Deel assesses the correct classification of your workforce and advises on their classification status (employee vs. contractor).

- Deel handles hiring and HR admin, creating localized contracts and collecting necessary compliance documentation for you.

- You and your worker can access one centralized platform to manage documentation, time off, payment approvals, and more.

Chloe Riesenberg, People Specialist, Project44

Tax obligations

You have no obligation to withhold taxes for your foreign independent contractors. However, even without tax withholding, tax reporting may still be necessary.

US-based companies, for example, must report the US-sourced income of foreign contractors to the IRS using forms 1042 and 1042-S unless the contractor’s country of residence has a tax treaty with the US, in which case companies should file exemption Form 8233.

Staying up-to-date on ever-changing tax regulations is a vital but time-consuming task. With Deel, you can confidently hand off that responsibility.

Deel has a team of local experts around the world who stay on top of local laws and regulations for you to ensure all workers are paid compliantly. Deel also provides all mandatory end-of-year documents for taxation—for example, W2 forms in the United States, T4 forms in Canada, P45s in the UK, and so on.

How Hero Gaming took their contractor payments to the next level

A pioneer in offering gamified casinos, Hero Gaming was founded in 2013 by Georg Westin. The company launched in 2014 and has since added multiple brands to its ever-growing portfolio.

Before Deel, Hero Gaming had issues paying all their teams manually. There was no formal process to track or approve invoices, and managers often needed to approve hours and pay to ensure everyone got accounted for. Sometimes there were even expired or missed invoices, and the team needed a way to ensure this no longer would be an issue.

With over 20 contractors across 11 different countries, Deel was able to help optimize Hero Gaming’s onboarding, HR, and global payroll processes. Our centralized platform for documentation ensured no contractor details were missed and helped the team stay organized.

Hero Gaming can now more efficiently manage invoices, guarantee manager approval, and track where money goes with a streamlined and flexible global payroll workflow.

Frequently asked questions about paying international contractors

What tax documents do I need when hiring foreign contractors?

The tax documents and obligations will depend on the contractor’s country of residence and any tax laws that apply to foreign workers where the company is based.

US-based companies, for example, must collect IRS form W-8BEN from their contractors (or W-8BEN-E for self-employed workers operating under a business entity) to confirm that the individual is not a US citizen and that the company is not obligated to withhold taxes.

Do US companies need to issue Form 1099 to foreign contractors?

No. Form 1099-NEC (and Form 1099-MISC in some cases) is issued to independent contractors based in the US that have been paid more than $600 within a tax year.

As long as your independent contractor is not a US citizen or making US-source income, you don’t need to collect a Form 1099 from them as they are not a US taxpayer.

Do I need to sign an independent contractor agreement with a foreign contractor?

No matter where the contractor is based, every company should sign an independent contractor agreement with their contract workers.

A well-drafted contractor agreement defines the nature of your working relationship, the scope of work, payment terms, and the ownership of the contractor’s work, especially regarding intellectual property. It can also serve as a point of reference to aid dispute resolution.

Protection clauses you should include in your foreign contractor agreement may depend on the local laws and regulations, so ask for help from a local legal expert to ensure your contract is foolproof.

How long does global payroll implementation take?

With Deel, global payroll implementation can take one to two months, depending on the number of employees and countries involved. Our process is much faster than competitors as we don’t use third-party providers.

How does Deel handle exchange rates?

With Deel, you can fund your global team in your preferred currency, and we’ll pay contractors in their local currency. Once contractors have their funds in their Deel Balance, they can withdraw in their local currency of choice, using whatever payment method they’d like.

We account for frequent exchange rate fluctuations by building it into your invoice. That means we take into account the exchange rate on the 25th and the 30th of the month (Forward Rate). We want to make sure there are no surprises on your end.

Deel: Making international payments to contractors fast and easy

Paying international contractors shouldn’t be a barrier to global hiring. With Deel, you can fund contractors with just a click and collect tax forms without lifting a finger. Our multiple currency options and various withdrawal methods make it even easier for your team to get paid on time every time.

Alex Bouaziz, Co-founder and CEO, Deel

Next steps

💸 Ready to hire and pay independent contractors via Deel?

Book a 30-minute product demo with an expert to get started.

🤔 Unsure how Deel differs from other platforms for paying foreign contractors?

Read this guide to see how we help you provide an elevated experience for your independent contractors while remaining compliant in 150+ countries.

Disclaimer: This content is published for informational purposes only and is not intended as legal or tax advice. Refer to a professional for guidance.